Market Value Per Share Formula

The market value per share represents the current price of a company s shares and it is the price that investors are willing to pay for common stocks. The book value per share and the market value per share are some of the tools used to evaluate the value of a company s stocks.

How Are Book Value And Market Value Different

Book value par value additional paid in capital retained earning.

Market value per share formula. Market value per share. The market value per share formula is the total market value of a business divided by the number of shares outstanding. Market value per share.

Where common stock at par par value number of shares issued. Market value per share the current market price or market value per share of. This gives the per share price in the market.

To calculate this market value ratio divide the price per share by the earnings per share. The market value per share is simply the going price of the stock. This reveals the value that the market currently assigns to each share of a company s stock.

The market price per share is used to determine a company s market capitalization or market cap to calculate it take the most recent share price of a company and multiply it by the total number of outstanding shares. Market value per share vs. Calculated as the total market value of the business divided by the total number of shares outstanding.

Market value per share is the price at which a share of company stock can be acquired in the marketplace such as on a stock exchange value investors closely follow this figure to determine when it makes sense to acquire shares at a sufficiently low price. Book value per share. Market value per share this is the ratio which is obtained by dividing the total market value of the shares of the company by the number of the shares which are outstanding.

The market price per share formula says this is equal to the total value of the company divided by the number of shares. Additional paid in capital number of shares amount at which shares issued par value retained earning net income dividend.

Valuation Ratios Accounting Play

Price To Earnings Ratio Formula Calculation Of Pe Ratio Example

Market Capitalization Formula How To Calculate Market Cap

Price To Book Value Ratio Guide Examples Of P B Ratio

Example Ias 33 Eps And Rights Issue Ifrsbox Making Ifrs Easy

Download How To Calculate Book Value Per Share Formula Isbn

Market To Book Ratio Formula Calculator Excel Template

Calculating The Valuation Of A Firm With Formula

Buybacks Are Making The Market Look Cheaper Than It Is Seeking Alpha

Book Value Per Share Formula Calculator Excel Template

Formulas For Book Value Per Share Bvps Earnings Per Share Eps

The Calculation Of Earnings Per Share And Market Value Of The

Market To Book Ratio Formula And Example Stock Analysis

The Definitive Guide How To Value A Stock The Motley Fool

Market To Book Ratio Price To Book Formula Examples

What Is The Intrinsic Value Of A Stock

How To Calculate The Book Value Per Share Quora

Solved You Must Come Up With Result Of Stock Value Per Sh

Earnings Per Share Dividends Formulas Examples Ratios

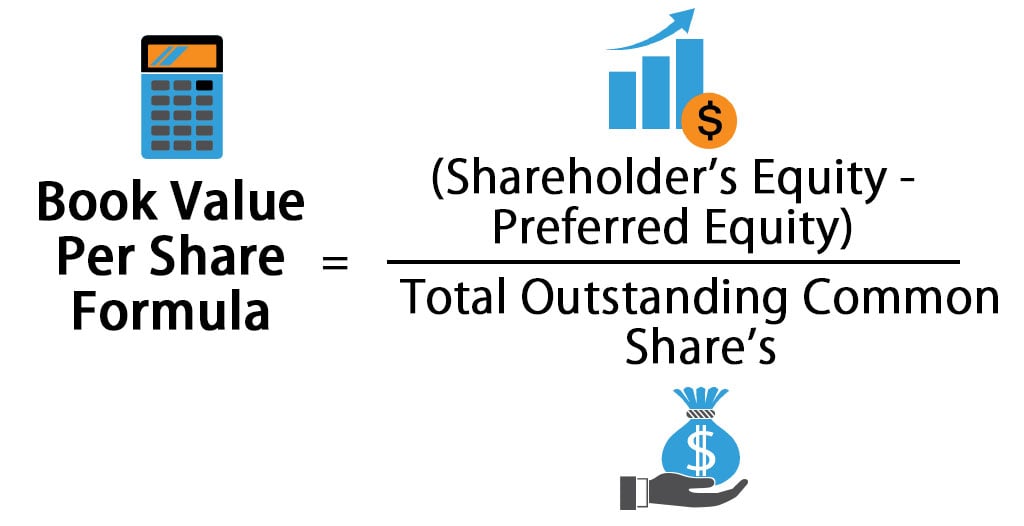

Book Value Per Share Formula How To Calculate Bvps

Earnings Per Share Formula Examples How To Calculate Eps

Forward Pe How To Calculate Forward Price Earnings Ratio

Market Value Ratios Calculation And Formulas Of Market Value Ratios

Price To Book Value Formula Calculator Excel Template

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsoqjdvny8c57wbttegkvhalkncywkuowryrfh1svsfbmt9 Kb4 Usqp Cau

Earnings Per Share Formula Examples How To Calculate Eps

Financial Statement Analysis Ppt Download

Price To Book Value Formula Calculator Excel Template

Book Value Per Share Bvps Overview Formula Example

Market To Book Ratio Formula Calculator Excel Template

Current Market Price Current Market Price Per Share

Valuation Ratios Accounting Play

What Is The Intrinsic Value Of A Stock

Market To Book Ratio Formula Calculation Example Limitations

Doc Ivle Notes On Earnings Per Share And Book Value Per Share

Market Value Of Equity Calculate Example Factors Vs Book

Posting Komentar

Posting Komentar