Bad Debt Expense Formula Aging Method

By reviewing historical data a company could determine that two percent of accounts 30 days old or less are typically unpaid and five percent of accounts 60 days or older go unpaid. In general the longer an account balance is overdue the less likely the debt is to be paid.

Aging Of Accounts And Mailing Statements Accountingcoach

Therefore the company will report an allowance and bad debt expense of 1 900 70 000 1 30 000 4.

Bad debt expense formula aging method. Example aging schedule let s assume that friends company a fictitious entity estimates bad debt expense with a periodic accounts receivable aging schedule. The aging method sorts each customer s unpaid invoices by invoice date into perhaps four columns. A common way of applying the allowance method is to estimate the bad debt expense is to analyze an aging accounts receivable ar report.

An aging schedule is arguably more precise than an average percentage because older accounts are assigned a higher percentage of bad debt estimation. An aging ar report provides accountants with a comprehensive view of the outstanding receivable balances and the number days they are past due. Column 1 lists the invoice amounts that are not yet due column 2 lists the invoice amounts that are 1 30 days past due column 3 lists the invoice amounts that are 31 60 days past due.

The classification of accounts receivable in the accounts receivable aging schedule also helps the business to identify the customers who take longer to pay so that they can restrict sales to those customers to reduce risk of bad debts. Focusing on the past due accounts receivable will assist you in estimating how much of the accounts receivable will never be collected. Accounts receivable aging is a technique to estimate bad debts expense by classifying accounts receivable of a business according to of length of time for which they have been outstanding and then estimating the probability of noncollection for each category.

Using the aging method all unpaid debts are categorized by time periods. Each category s overall balance is multiplied by an estimated percentage of uncollectibility for that category and the total of all such calculations serves as the estimate of bad debts. How does the aging of accounts receivable determine bad debts expense.

If the next accounting period results in an estimated allowance of 2 500 based. Under the allowance method of calculating bad debts there are two general ledger accounts bad debts an expense account and allowance for doubtful accounts a contra asset account used to offset to the accounts receivable balance. Therefore many companies maintain an accounts receivable aging schedule which categorizes each customer s credit purchases by the length of time they have been outstanding.

For example a company divides debts by 30 days outstanding and 60 days outstanding. Estimate the percent of the ar balance that is uncollectible. Bad debt expense formula sale for accounting period estimated of bad debts in the percentage of outstanding debtor a certain percentage of debtors is recorded as bad debt expense based on their aging or in simple word based on how old debtors are.

To record the bad debt expenses you must debit bad debt expense and a credit allowance for doubtful accounts. The aging of accounts receivable allows you to quickly identify the credit customers that are past due and the length of time that the amounts have been past due.

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Answered Casilda Company Uses The Aging Approach Bartleby

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqlhabnij N Camfnw3dru0jdpfxweibf3jqrpzuwvm9fcjhggy Usqp Cau

Accounts Receivable Bad Debt Expense Using Aging Schedule For

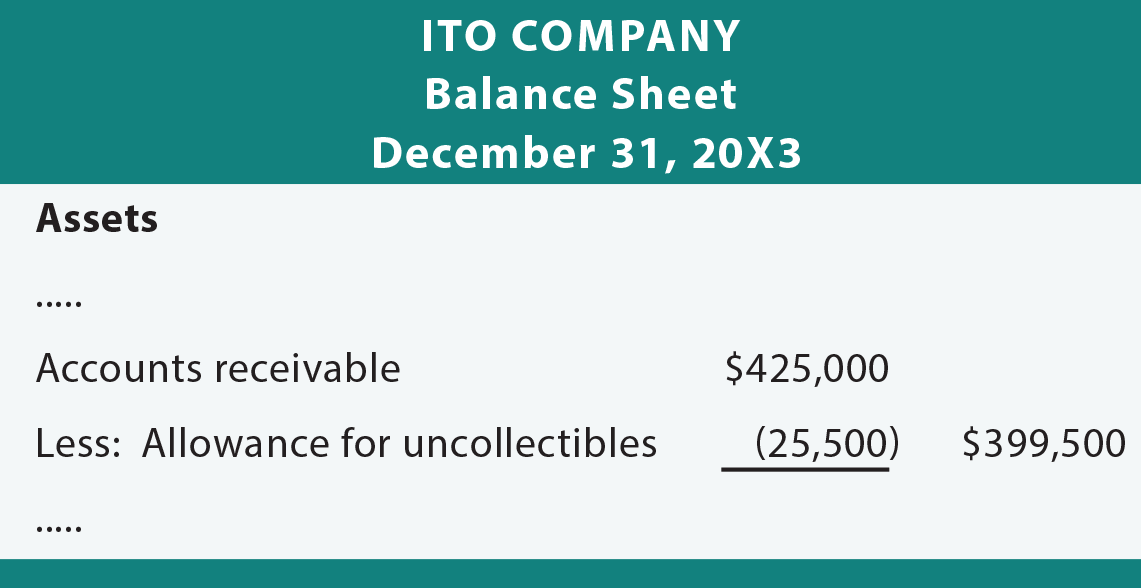

Allowance Method For Uncollectibles Principlesofaccounting Com

Accounts Receivable Aging Method Definition Allowance For

Chapter 8 Receivables Ppt Download

Estimating Bad Debts Financial Accounting

Receivables Bad Debt Expense And Interest Revenue Ppt Download

Receivables Bad Debt Expense And Interest Revenue Ppt Download

Accounts Receivable Aging Definition

Bad Debt Expense Formula How To Calculate Examples

Ppt Chapter 8 Powerpoint Presentation Free Download Id 1665126

Aging Method Of Accounts Receivable Uncollectible Accounts Play

Estimating The Amount Of Uncollectible Accounts

Estimating The Amount Of Uncollectible Accounts

Aging Method For Estimating Uncollectible Accounts Youtube

Account For Uncollectible Accounts Using The Balance Sheet And

Solved Determining Bad Debt Expense Using The Aging Metho

Solved Blue Skies Equipment Company Uses The Aging Approa

Accounts Receivable Aging Definition

Solved Planeto Uses The Aging Method Percentage Of Accou

Solved P6 4 Determining Bad Debt Expense Based On Aging Analysis

Estimating Allowance For Doubtful Accounts By Aging Method

Solved Stavros Company Uses The Aging Method Percentage

Estimating Bad Debts Allowance Method

9 7 Appendix Comprehensive Example Of Bad Debt Estimation

Allowance Method For Uncollectibles Principlesofaccounting Com

Bad Debt Aging Of Accounts Receivable Method Youtube

Account For Uncollectible Accounts Using The Balance Sheet And

Aging Of Accounts Receivable Method Brandongaille Com

Accounts Receivable Aging Method Definition Allowance For

Determining Bad Debt Expense Using The Aging Method At The

Solved Determining Bad Debt Expense Using The Aging Method At

Chapter 8 Receivables Ppt Download

Direct Write Off And Allowance Methods For Dealing With Bad Debt

Estimating Bad Debts Allowance Method

Estimating Allowance For Doubtful Accounts By Aging Method

Aging Method Of Accounts Receivable Uncollectible Accounts Play

Posting Komentar

Posting Komentar