Face Value Of A Bond

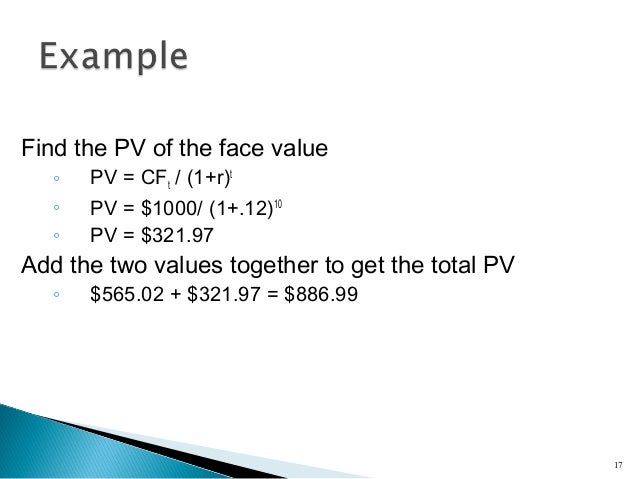

This calculation is i the periodic interest paid. Before maturity the actual value of a bond may be greater or less than face value depending on the interest rate payable and the perceived risk of default.

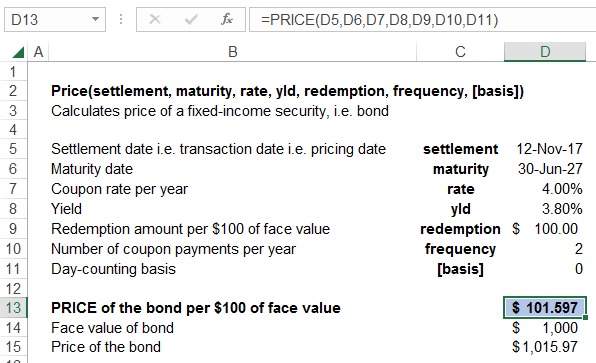

Bond Price Calculation In Excel Example

Bond Price Calculation In Excel Example

Guarantee a bond is eligible to be cashed.

Face value of a bond. A bond s coupon rate is the rate at which it earns these returns and payments are based on the face value. The savings bond calculator will not. The face value of a bond also called its par value is the price you pay for it.

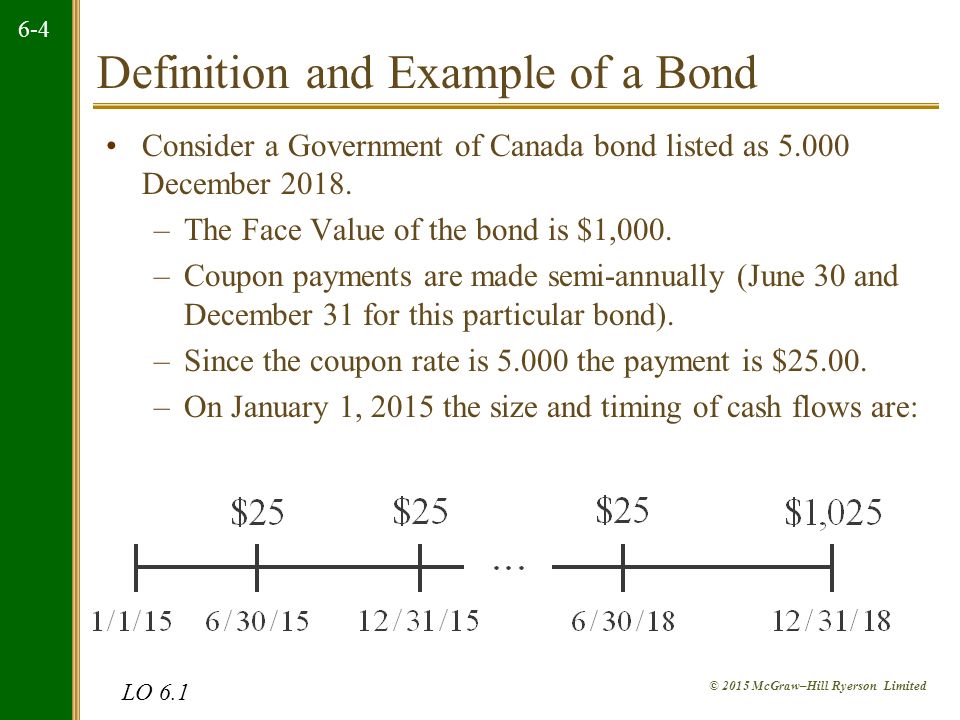

For example if the bond pays interest semiannually i 30 per period. That would mean interest payments totaling 50 annually for a bond with a 1 000 face value. Although a bond s current value can change over time the face value remains the same.

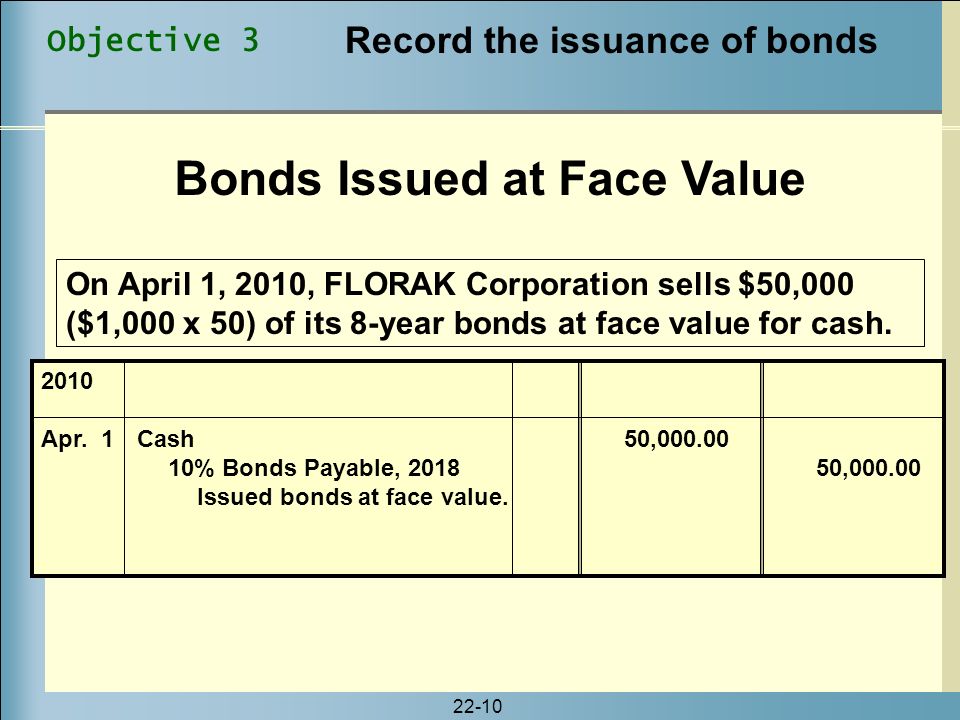

The journal entry to record bonds that a company issues at face value is to debit cash and credit bonds payable. Bonds issued at face value are one of the easiest type of bond transaction to account for. As bonds approach maturity actual value approaches face value.

So if the corporation issues bonds for 100 000 with a five year term at 10 percent the journal. Bond interest rates the annual interest rate a bond pays is expressed as a percentage of par or face value at issuance. The face value is used to calculate the cash interest payments required during the life of the bond and it indicates the cash amount that must be paid at the maturity date.

This bond issue would also pay interest in an amount per bond that is impacted by the amount of the face value. Verify whether or not you own bonds. In the case of stock certificates face value is the par value of the stock.

For bonds it is the amount paid to. Divide the annual interest amount by the number of times interest is paid per year. The annual interest is 60.

Calculate the value of a bond based on the series denomination and issue date entered. For example an 8 percent bond will pay 8 percent. Assume that a bond has a face value of 1 000 and a coupon rate of 6.

For example if a corporation issues a bond payable having a face value of 1 000 000 and a stated interest rate of 6 per year it is likely that the bond issuer is. Store savings bond information you enter so you can view it again at a later date. So if a bond holds a 1 000 face value with a 5 coupon rate then that would leave you with 50 in returns annually.

Face value also known as the par value is equal to a bond s price when it is first issued after that the price of the bond fluctuates in the market in accordance with changes in interest rates. For example if the bonds paid 5 it means they will pay interest amounting to 5 of the bond s face value each year. Face value is the nominal value or dollar value of a security stated by the issuer.

For stocks it is the original cost of the stock shown on the certificate. Guarantee the serial number you enter is valid. Each period is 6 months.

This is in addition to the issuer paying you back the bond s face value on its maturity date.

Discount Bond Definition Examples Top 2 Types Of Discount Bonds

Discount Bond Definition Examples Top 2 Types Of Discount Bonds

How To Calculate Carrying Value Of A Bond With Pictures

How To Calculate Carrying Value Of A Bond With Pictures

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrn9zmaihb9j7h8w0scw3 Ekico36fw5lrymsrednij5tiecrb3 Usqp Cau

How To Calculate Present Value Of A Bond

Zero Coupon Bond Value Formula With Calculator

Zero Coupon Bond Value Formula With Calculator

What Is Face Value Definition And Meaning Market Business News

What Is Face Value Definition And Meaning Market Business News

Solved Issue Price Youngblood Inc Plans To Issue 500 0

Solved Issue Price Youngblood Inc Plans To Issue 500 0

A 10 Year Bond Pays 5 On A Face Value Of 1 000 If Similar Bonds

A 10 Year Bond Pays 5 On A Face Value Of 1 000 If Similar Bonds

How To Calculate An Interest Payment On A Bond 8 Steps

How To Calculate An Interest Payment On A Bond 8 Steps

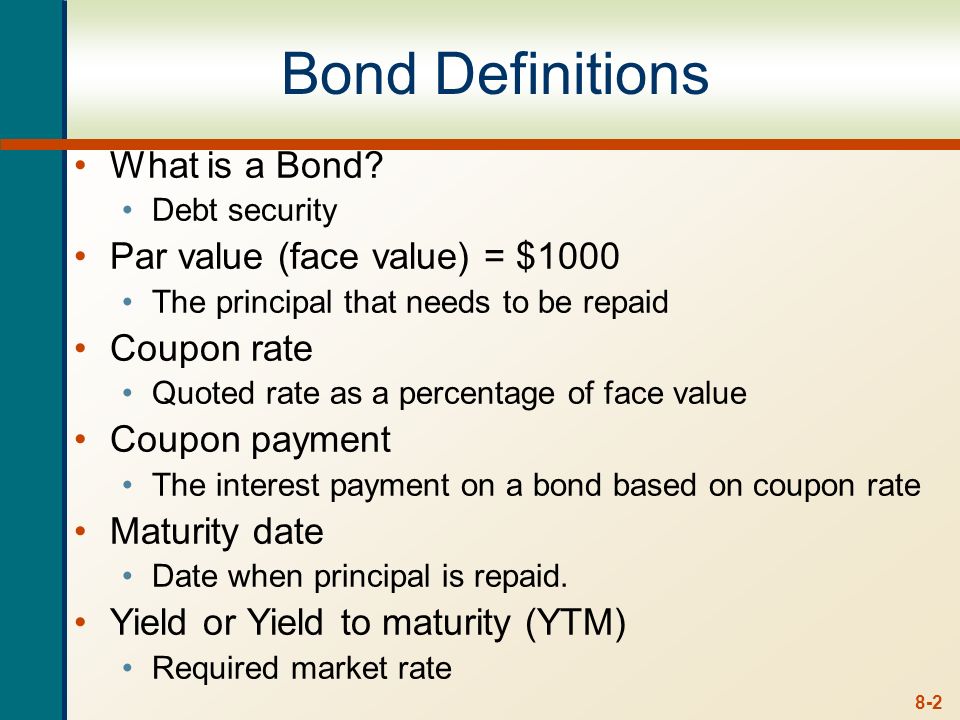

Chapter 7 Outline Bonds And Bond Valuation More On Bond Features

Chapter 7 Outline Bonds And Bond Valuation More On Bond Features

Valuing Bonds Boundless Finance

Valuing Bonds Boundless Finance

Answered A Bond That Matures In 7 Years Sells Bartleby

Answered A Bond That Matures In 7 Years Sells Bartleby

How To Calculate Pv Of A Different Bond Type With Excel

Solved The Following Table Shows Some Data For Three Zero

Solved The Following Table Shows Some Data For Three Zero

Carrying Value Of Bond How To Calculate Carrying Value Of Bonds

Carrying Value Of Bond How To Calculate Carrying Value Of Bonds

Solved Assume A 1 000 Face Value Bond Has A Coupon Rate

Solved Assume A 1 000 Face Value Bond Has A Coupon Rate

Measurement Of Bonds Cfa Level 1 Analystprep

Measurement Of Bonds Cfa Level 1 Analystprep

How To Calculate Present Value Of A Bond

Microsoft Excel Bond Valuation Tvmcalcs Com

How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel

What Is The Face Value Of A 10 Year 10 000 Bond That Pays A 5

How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel

4 Usual Confusions In Bond Valuation Tutorial For Bond Value

4 Usual Confusions In Bond Valuation Tutorial For Bond Value

Understanding Bond Prices And Yields

All The 21 Types Of Bonds General Features And Valuation Efm

All The 21 Types Of Bonds General Features And Valuation Efm

Section 1 Financing Through Bonds Ppt Video Online Download

Section 1 Financing Through Bonds Ppt Video Online Download

How To Calculate Carrying Value Of A Bond With Pictures

How To Calculate Carrying Value Of A Bond With Pictures

Bond Valuation Formula Steps Examples Video Lesson

Bond Valuation Formula Steps Examples Video Lesson

Chapter Outline 6 1 Definition And Example Of A Bond 6 2 How To

Chapter Outline 6 1 Definition And Example Of A Bond 6 2 How To

Valuing Bonds Lecture 6 Online Presentation

Valuing Bonds Lecture 6 Online Presentation

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Pv Of A Different Bond Type With Excel

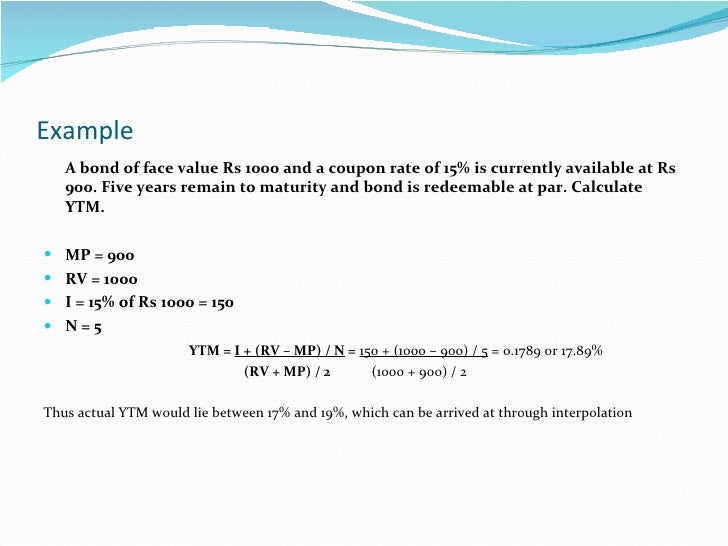

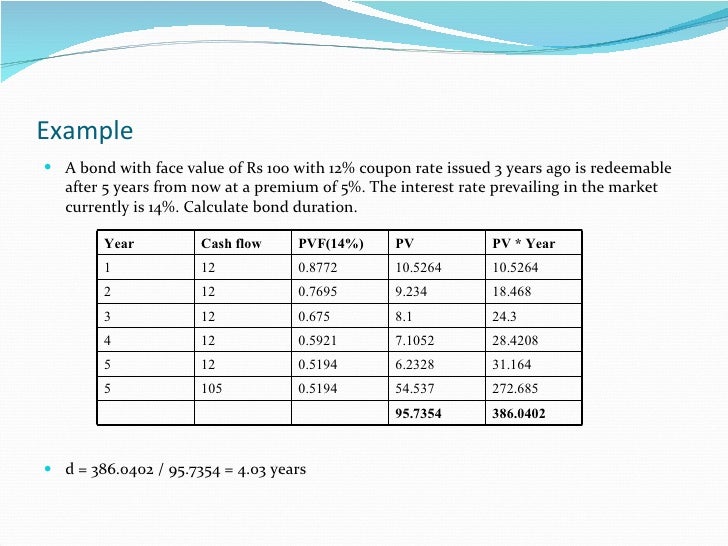

Bond Valuation Financial Management

Bond Valuation Financial Management

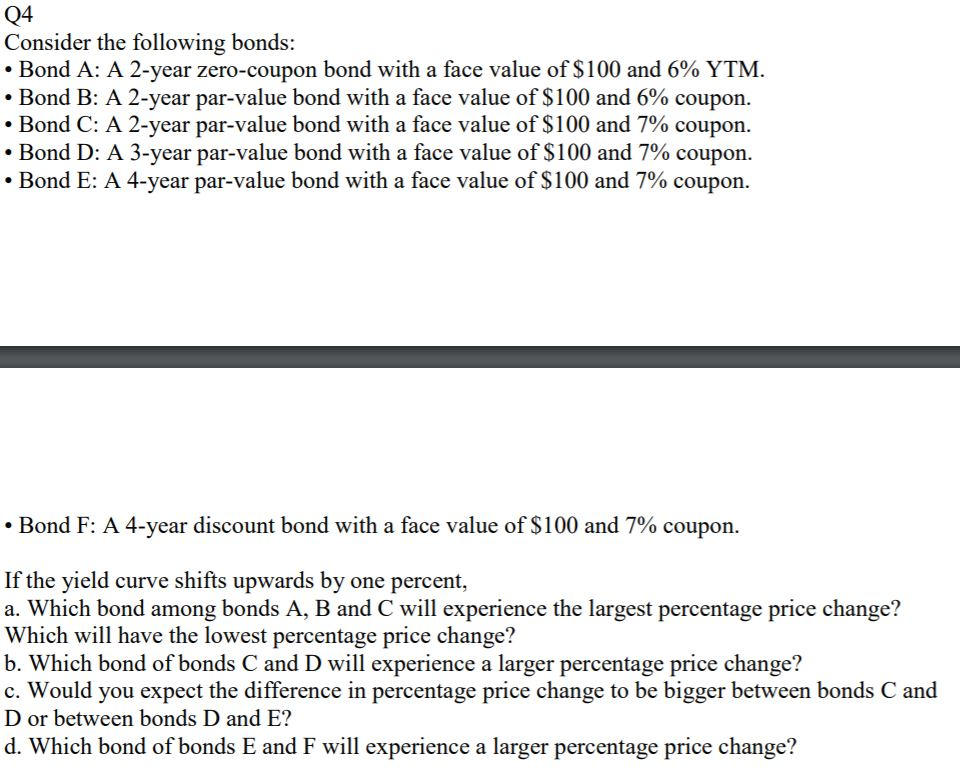

Solved Q4 Consider The Following Bonds Bond A A 2 Yea

Solved Q4 Consider The Following Bonds Bond A A 2 Yea

Posting Komentar

Posting Komentar