Why Are Market Value Ratios Important

The most common market value ratios are as follows. Financial ratios are very important for investors because by using these ratios investors find the operational efficiency liquidity profitability and stability of any company.

Debt To Equity Ratio D E Definition

To a value seeking investor a company that trades for a p b ratio of 0 5 is attractive because it implies that the market value is one half of the company s stated book value.

Why are market value ratios important. These ratios are used for making share investment decisions. Market value ratios are used to evaluate the current share price of a publicly held company s stock. Valuing a listed company is a complex task and several different measures are used to arrive at a fair valuation while none of the methods are precise.

Information gain through the financial ratios is much more than the information gain by the raw financial data of the company. P e ratio market price per share earnings per share pe ratio value varies from industry to industry. These ratios are employed by current and potential investors to determine whether a company s shares are over priced or under priced.

Price to earnings ratio is one of the most widely used ratios by the investors throughout the world. The market value ratios are important for the investors as these ratios are used to decide the prices of the shares whether overpriced or undervalued or at par with the market. Growth and profitability are other areas of your business performance that you can monitor by measuring select financial ratios.

Book value per share. Here are few of the most important financial ratios for investors to validate a company s valuation. This ratio will help gauge your company s debt capacity or.

This is because prices in the stock market are generally a reflection of the long term value that investors see in the company. Debt to equity growth is an admirable goal but small businesses must be careful not to grow too fast. Pe ratio is calculated by.

Unless the market is being completely driven by sentiments at a given point of time market related ratios expose the fundamentals of the company in question. Although a wide variety of market value ratios are available the most popular include earnings per share book value per share and the price earnings ratio others include the price cash ratio dividend yield ratio market value per share and the market book ratio each of these measures is used in a different way but when combined they offer a financial portrait of publicly traded companies. Through ratio analysis investors analyze that which is the best.

19 Most Important Financial Ratios For Investors In 2020

Price To Book Value Ratio P Bv Or P B Ratio Equitymaster

Using Price To Book Ratio To Evaluate Companies

Equity Value Formula Calculator Excel Template

Key Valuation Ratios And When To Use Which One Toptal

Market To Book Ratio Price To Book Formula Examples

Market Value Ratios Calculation And Formulas Of Market Value Ratios

Price To Book Value Ratio Guide Examples Of P B Ratio

Market Value Ratios And How They Are Used

Market To Book Ratio Formula And Example Stock Analysis

Understanding The Value Of Price To Book Ratio

Using The Price To Book Ratio To Analyze Stocks The Motley Fool

Definition Corporate Finance Studocu

Enterprise Value Ev Formula Definition And Examples Of Ev

Market Vs Book Value Wacc Definition Benefit Disadvantage

Market To Book Ratio Formula Examples Calculations

Price To Book Value Ratio Guide Examples Of P B Ratio

Market To Book Ratio Formula Calculation Example Limitations

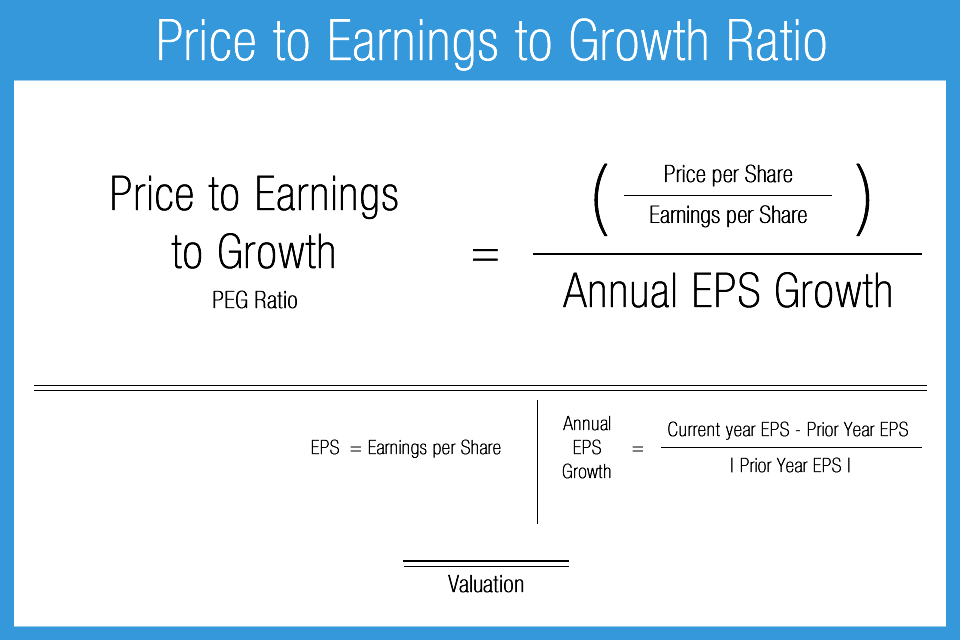

Valuation Ratios Accounting Play

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsiw7po Zd7x3xzcxhwj8bl7el74zcyabyzcn1xerpbcnbjzugq Usqp Cau

Book Value Of Equity Meaning Formula Calculation Limitation

Market To Book Ratio Formula Examples Calculations

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Company Valuation Ratios Fidelity

Valuation Ratios Accounting Play

Valuation Ratios Accounting Play

Loan To Value Ratio Definition And Calculation

Solved 6 Market Value Ratios Aaa Aa Ratios Are Mostly Ca

Analyze Investments Quickly With Ratios

Loan To Value Ratio Ltv Meaning Formula Calculation

Valuation Ratios Accounting Play

Equity Valuation Methods Types Balance Sheet Dcf Earnings

Market To Book Ratio Price To Book Formula Examples

Key Valuation Ratios And When To Use Which One Toptal

Using The P E Ratio To Value A Stock

Posting Komentar

Posting Komentar