What Are Product Costs And Period Costs

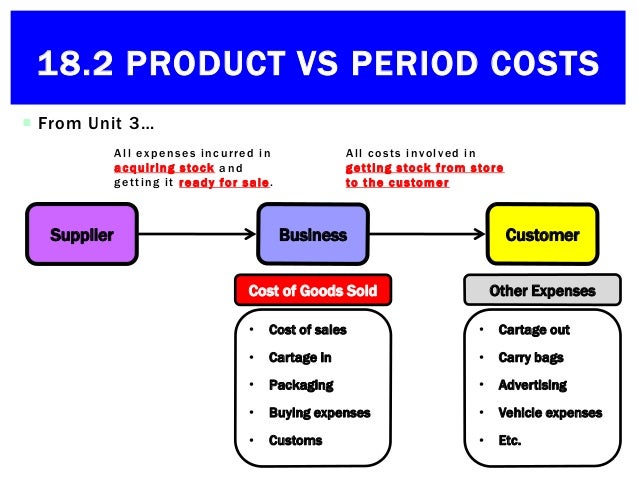

For a retailer the product. Period costs are not a necessary part of the manufacturing process.

Product And Period Costs Double Entry Bookkeeping

Product And Period Costs Double Entry Bookkeeping

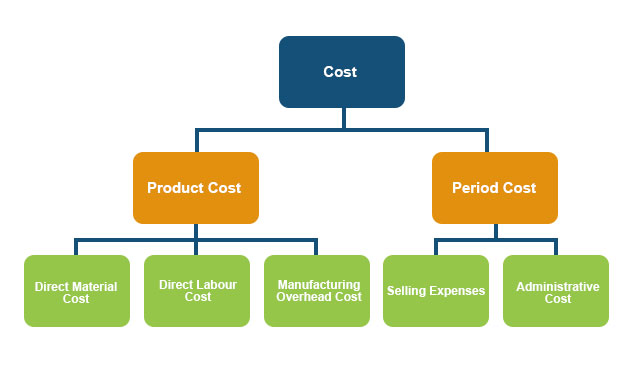

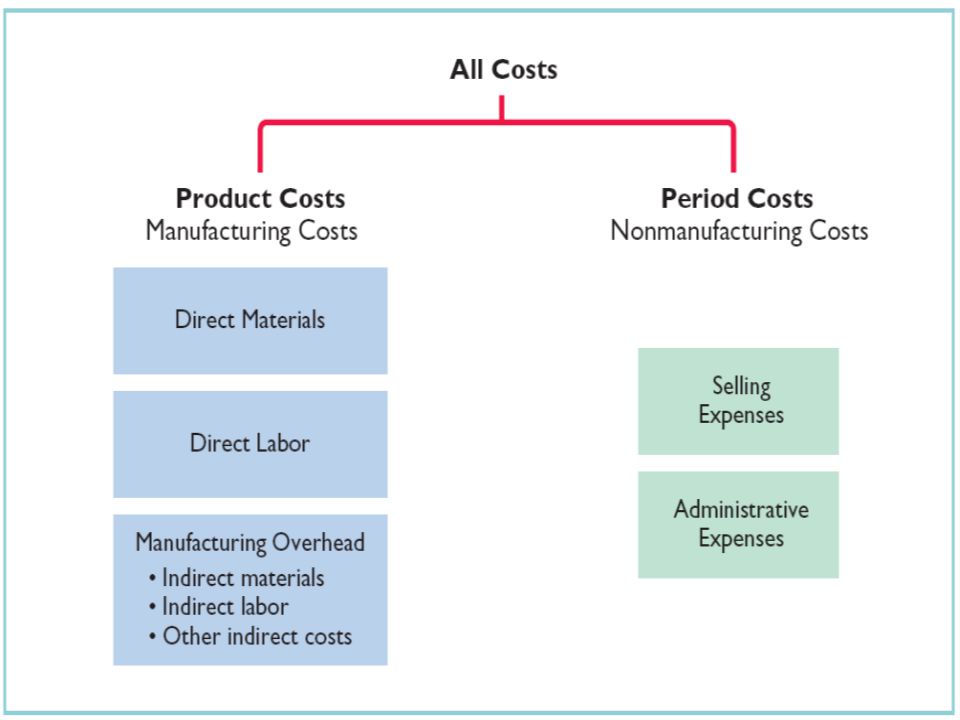

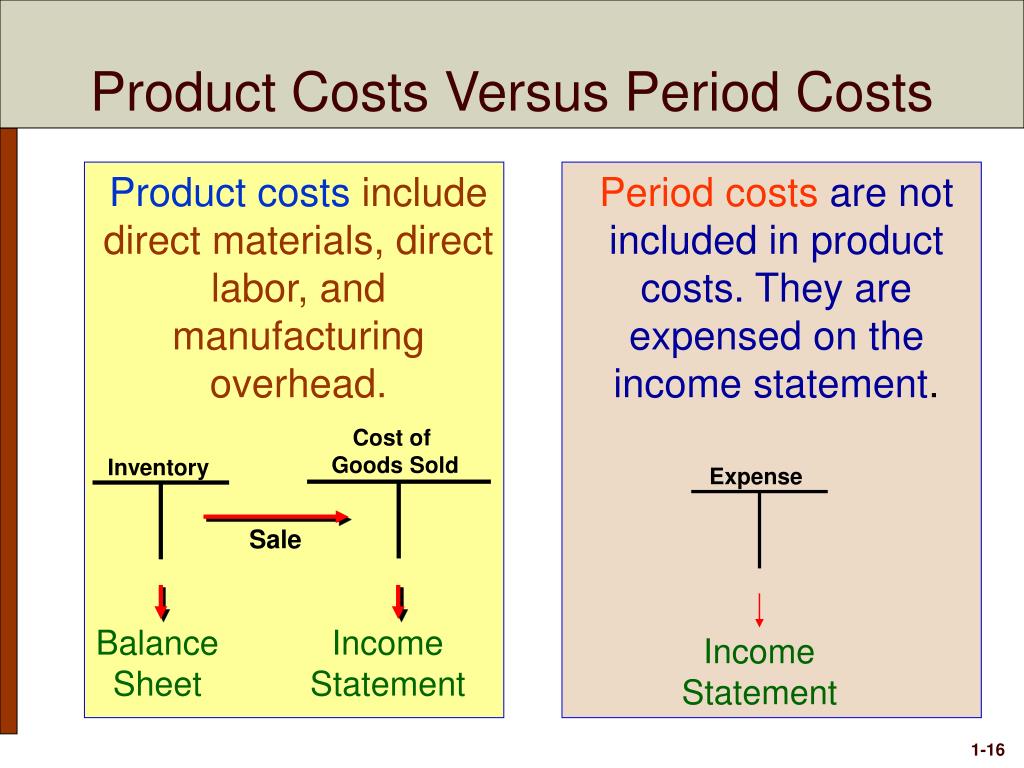

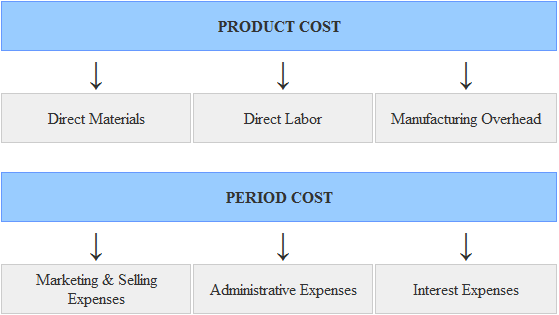

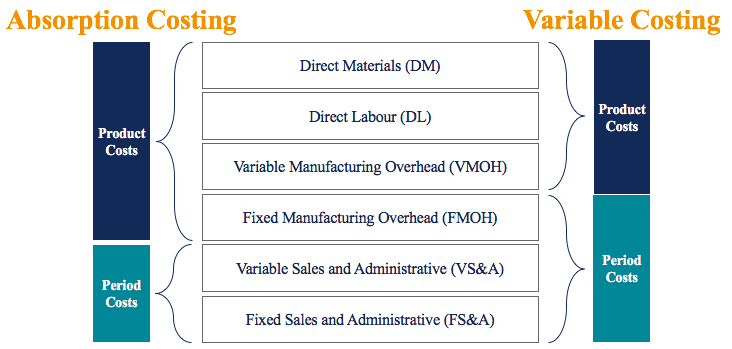

The product costs of direct materials direct labor and manufacturing overhead are also inventoriable costs since these are the necessary costs of manufacturing the products.

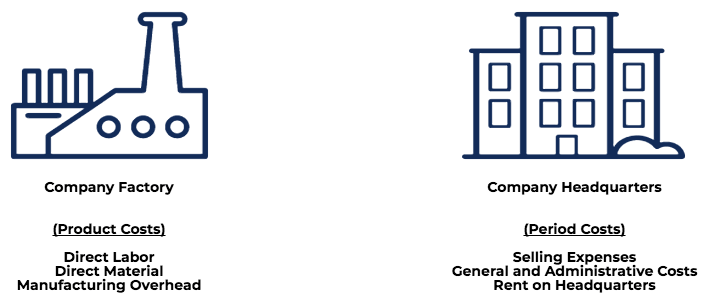

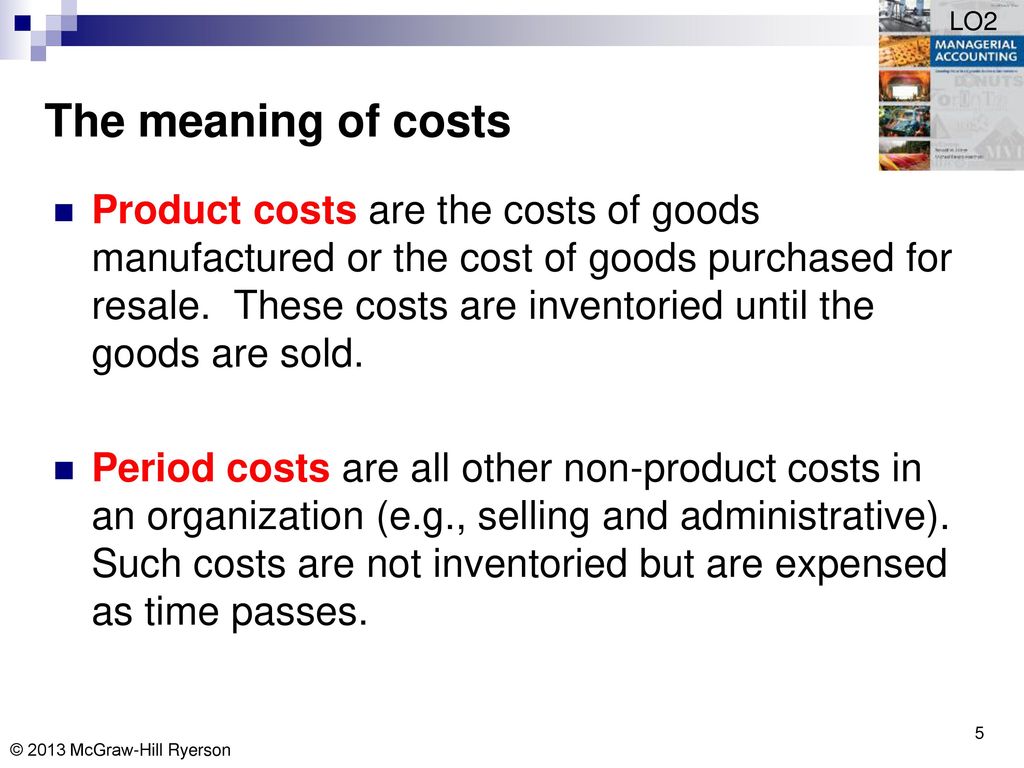

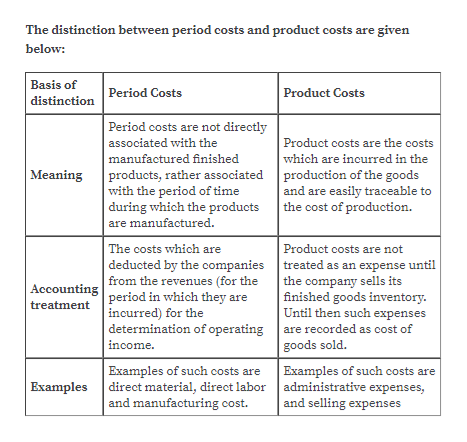

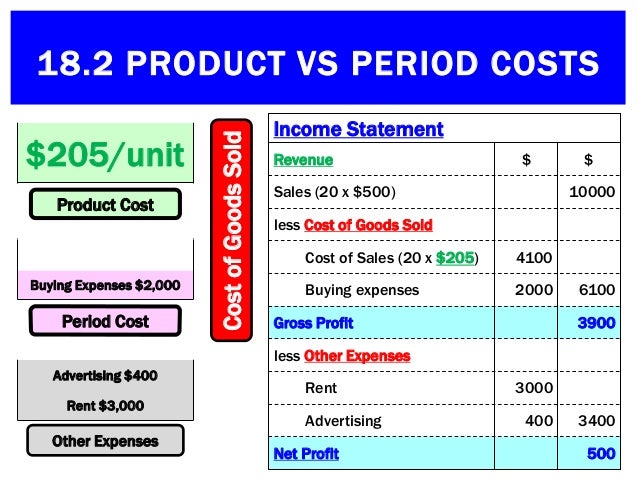

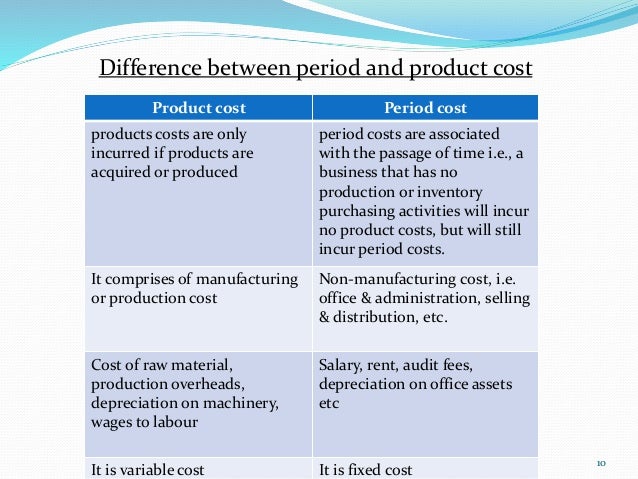

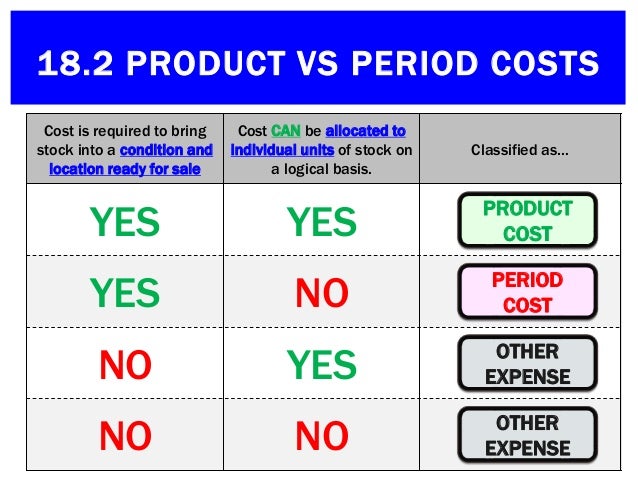

What are product costs and period costs. Product costs are the direct costs involved in producing a product. Expensed on the income statement in the period incurred. The key difference between product costs and period costs is that product costs are only incurred if products are acquired or produced and period costs are associated with the passage of time.

Product cost is the cost which can be directly assigned to the product. Capitalized on the balance sheet as inventory and eventually expensed to cost of goods sold on the income statement. Usually these costs are not part of the manufacturing process and are therefore treated as expense for the period in which they arise.

The key difference between product cost and period cost is that product cost is the cost which the company incurs only in case it produces any products and those costs are apportioned to a product whereas period costs are the costs which are incurred by the company with the passage of time and they are not apportioned to any product rather charged as an expense in income statement. Thus a business that has no production or inventory purchasing activities will incur no product costs but will still incur period costs. How are period costs and product costs different.

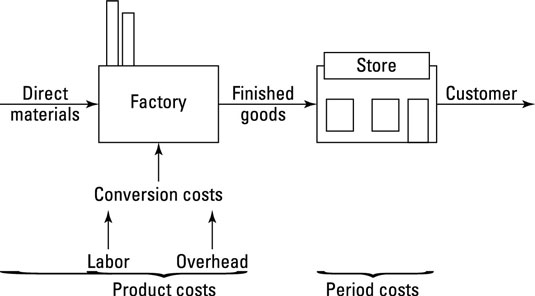

The costs that are not included in product costs are known as period costs. As a result period costs cannot be assigned to the products or to the cost of inventory. Consider the diagram below.

Period costs are basically all costs other than product costs. Product costs are costs necessary to manufacture a product while period costs are non manufacturing costs that are expensed within an accounting period. Product cost is based on volume because they remain same in the unit price but differ in the total value.

Period cost is the cost which relates to a particular accounting period. Product costs period costs. These are not incurred on the manufacturing process and therefore these cannot be assigned to cost goods manufactured.

Product costs are expenses in the period the product is sold. Period costs are thus expensed in the period in which they are incurred. Period costs are not attached to products and company does not need to wait for the sale of products to recognize them as expense.

Costs not related to the production of a product. Costs related to the production of a product. Costs on financial statements product costs are treated as inventory.

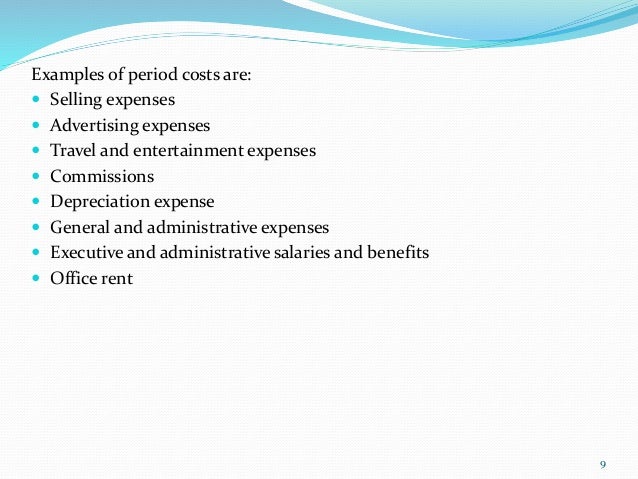

Period costs are all costs not included in product costs. Example of period costs are advertising sales commissions office supplies. Period costs are not directly tied to the.

Period Cost Vs Product Cost 7 Most Valuable Differences To Learn

Period Cost Vs Product Cost 7 Most Valuable Differences To Learn

Solved Giant Manufacturing Specializes In Manufacturing B

Solved Giant Manufacturing Specializes In Manufacturing B

Product Costs Types Of Costs Examples Materials Labor Overhead

Product Costs Types Of Costs Examples Materials Labor Overhead

Product Vs Period Costs Youtube

Product Vs Period Costs Youtube

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrfi9zhtd8 Qtva8 Rmbtp6jmb6inkrdwa0 Pxxcdkaipny9egm Usqp Cau

Product Cost Vs Period Cost Youtube

Product Cost Vs Period Cost Youtube

Manufacturing Cost Terms Ppt Video Online Download

Manufacturing Cost Terms Ppt Video Online Download

Distinguish Between Product Cost And Period Cost Qs Study

Distinguish Between Product Cost And Period Cost Qs Study

Difference Between Product Cost And Period Cost With Comparison

Difference Between Product Cost And Period Cost With Comparison

Inventoriable Product And Period Costs Youtube

Inventoriable Product And Period Costs Youtube

Managerial Accounting Product Vs Period Cost Classifications

Managerial Accounting Product Vs Period Cost Classifications

Ppt An Introduction To Managerial Accounting And Cost Concepts

Ppt An Introduction To Managerial Accounting And Cost Concepts

What Is Product Costs And Period Costs Qs Study

Product Costs And Period Costs Explanation And Examples

Product Costs And Period Costs Explanation And Examples

Solved Georgia Pacific A Manufacturer Incurs The Follow

Solved Georgia Pacific A Manufacturer Incurs The Follow

Product Cost By Period Or Product Cost By Order Sap Documentation

Product Cost By Period Or Product Cost By Order Sap Documentation

Period Cost Vs Product Cost 7 Most Valuable Differences To Learn

Period Cost Vs Product Cost 7 Most Valuable Differences To Learn

The Difference Between Product And Period Costs Dummies

The Difference Between Product And Period Costs Dummies

Basic Cost Management Concepts Ppt Download

Basic Cost Management Concepts Ppt Download

Product Costs And Period Costs Explanation And Examples

Product Costs And Period Costs Explanation And Examples

Product Cost Vs Period Cost Top 6 Best Difference Infographics

Product Cost Vs Period Cost Top 6 Best Difference Infographics

Answered Distinguish Between Product Costs And Bartleby

Answered Distinguish Between Product Costs And Bartleby

Variable Costing Overview Examples And Accounting Formulas

Variable Costing Overview Examples And Accounting Formulas

Product Costs And Period Costs Definition Explanation

Product Costs And Period Costs Definition Explanation

Doc Product Costs And Period Costs Kabbo Ahmed Rahat Academia Edu

Doc Product Costs And Period Costs Kabbo Ahmed Rahat Academia Edu

Absorption Vs Variable Costing Resulting Difference In Operating

Absorption Vs Variable Costing Resulting Difference In Operating

Product Cost Or Period Cost Suppose That You Have Been

Product Cost Vs Period Cost Google Search Period The Unit Cost

Product Cost Vs Period Cost Google Search Period The Unit Cost

Orange Connect Managerial Accounting Chapter 1

Orange Connect Managerial Accounting Chapter 1

Orange Connect Managerial Accounting Chapter 1

Orange Connect Managerial Accounting Chapter 1

What Is The Answer To 4 Because Everytime I Do It I Get It Wrong

What Is The Answer To 4 Because Everytime I Do It I Get It Wrong

Manufacturing And Non Manufacturing Costs Online Accounting

Accounting Ii Chapter 18 Powerpoint

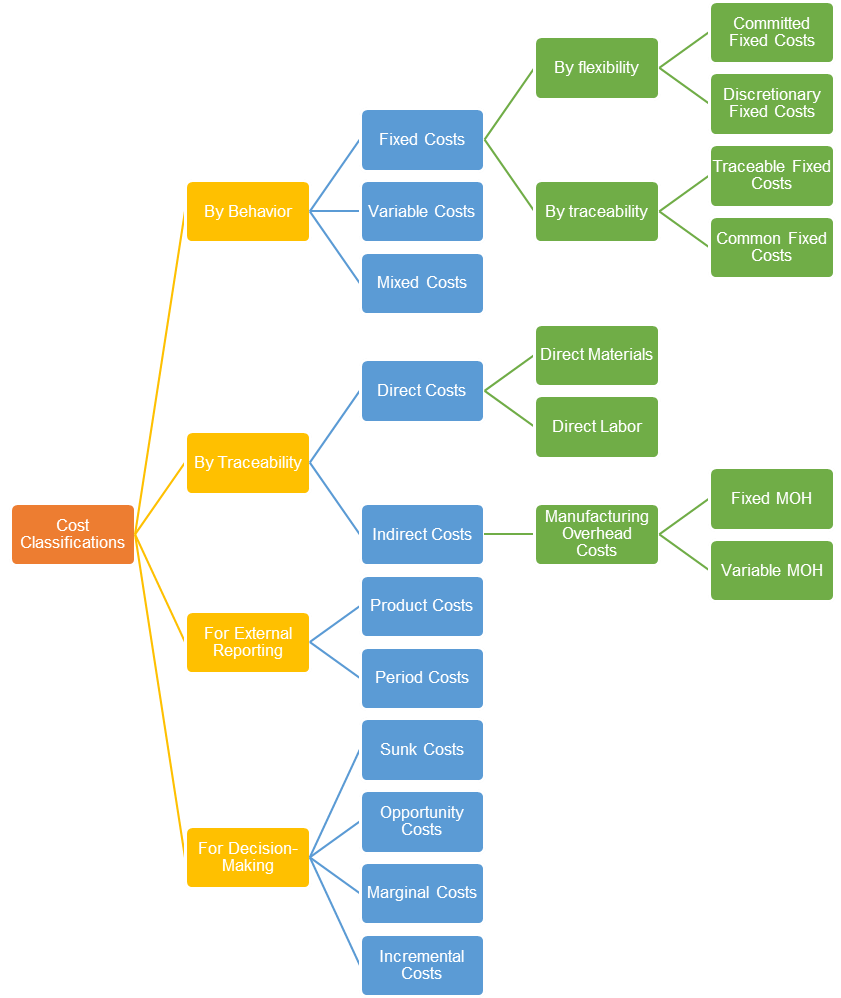

Cost Classifications By Behavior Nature And Function

Cost Classifications By Behavior Nature And Function

Posting Komentar

Posting Komentar