Opportunity Cost Of Capital

This is the opportunity cost of capital. Opportunity cost refers to a benefit that a person could have received but gave up to take another course of action.

January 2017 Data Update 6 A Cost Of Capital Update

Cost of capital includes the cost of debt and the cost of equity.

Opportunity cost of capital. Opportunity cost of capital expected return that is forgone by investing in a project rather than in comparable financial securities. Opportunity cost of capital the difference in return between an investment one makes and another that one chose not to make. The opportunity cost of capital is any money that is risked by a business when it chooses to invest its funds in a new project or initiative rather than in investment securities.

The best way to calculate the opportunity cost of capital is to compare the return on investment on two different projects. These comparisons often arise in finance and economics when trying to decide between investment options. The opportunity cost of capital is the incremental return on investment that a business foregoes when it elects to use funds for an internal project rather than investing cash in a marketable security thus if the projected return on the internal project is less than the expected rate of return on a marketable security one would not invest in the internal project assuming that this is the.

This may occur in securities trading or in other decisions. Opportunity cost of a capital is a term unique to economics and finance. It is not an explicit cost which is paid out of the pocket.

Stated differently an opportunity cost represents an alternative given up. The opportunity cost is the percentage return lost for rejecting one project and accepting another. For example if a person has 10 000.

If a project is of similar risk to a company s average business activities it is reasonable to use the company s average cost of capital as a basis for. Opportunity cost is the comparison of one economic choice to the next best choice. The goal is always to accept the project with the lower cost of capital which delivers the highest return on investment.

Hence there is no mention of this cost in the accounting records. Cost of capital is a necessary economic and accounting tool that calculates investment opportunity costs and maximizes potential investments in the process. The opportunity cost attempts to quantify the impact of choosing one investment over another.

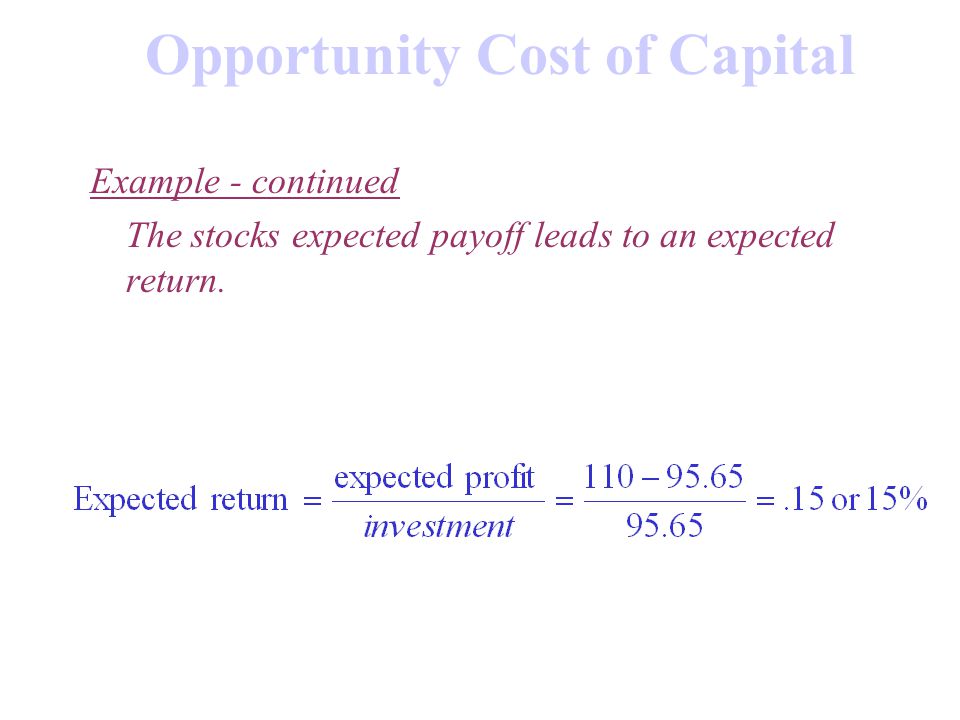

This cost is calculated by projecting the rate of return for both the project and the investments. In other words the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk. Cost of capital is the required return necessary to make a capital budgeting project such as building a new factory worthwhile.

It is unique in the sense that you will not find mention of opportunity cost of capital in the accounting books.

Ch05a Opportunity Cost Of Capital Opportunity Investment Risk

Solved If The Opportunity Cost Of Capital Is 10 Calcula

1 Supplementary Notes Present Value Net Present Value Npv Rule

Opportunity Cost Of Capital 5 4 1 Youtube

Different Methods For Estimating Opportunity Cost Of Capital

Cost Of Capital Powerpoint Slides

Exhibit 2 1 Production Possibilities Curv E Data Consumption Goods

Debt Service Coverage The Opportunity Cost Of Capital Bridging

Financial Cost Of Capital And Opportunity Cost Of Capital Eme

The Cost Of Capital The Cost Of Capital Is The Capital Budgeting

Cost Of Capital Define Types Debt Equity Wacc Uses

Fine 3100 Chapter 11 Introduction To Risk Return And The

Treasury Cafe Is My Weighted Average Cost Of Capital Wacc Y

Pdf The Opportunity Cost Of Capital

Solved Npv Calculate The Npv For Each Of The Two Mutually

Solved If The Opportunity Cost Of Capital Is 11 Calcula

Http People Stern Nyu Edu Adamodar Pdfiles Papers Costofcapital Pdf

Estimating The Economic Opportunity Cost Of Capital For Public

Chapter 16 Cost Of Capital Capital Definition

Socc Social Opportunity Cost Of Capital In Undefined By

Ppt Present Value And The Opportunity Cost Of Capital Powerpoint

The Opportunity Cost Of Capital Reformation Partners

Solved Exhibit 2 1 Production Possibilities Curv E Data C

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqm5fgewfvrtpdr G3opdokwt0q5u3blkcnt8ujevhc30cvpk43 Usqp Cau

Solved What Is The Opportunity Cost Of Investing In Capit

Present Value And The Opportunity Cost Of Capital Ppt Video

Ppt Chapter 2 Powerpoint Presentation Free Download Id 6161725

Solved Consider The Following Net Cash Flows A What Is T

Present Value And The Opportunity Cost Of Capital Online

Introduction To Risk Return And Opportunity Cost Of Capital

Tutorial 2 Answers Ec3010 City Studocu

The Opportunity Cost Of Capital Semantic Scholar

10 Cash Flow In Capital Budgeting

Opportunity Cost Of Capital And Capital Budgeting Ppt Video

Financial Cost Of Capital And Opportunity Cost Of Capital Eme

Different Methods For Estimating Opportunity Cost Of Capital

Ansgar John Sinaas We Re Right And They Re Wrong Cost Of

Posting Komentar

Posting Komentar